Kotak Fixed Deposit Rates

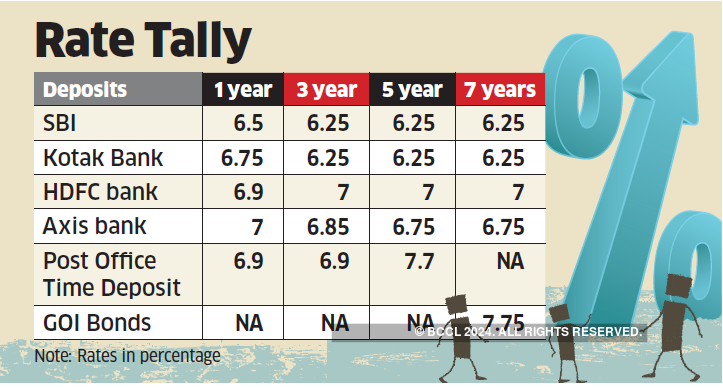

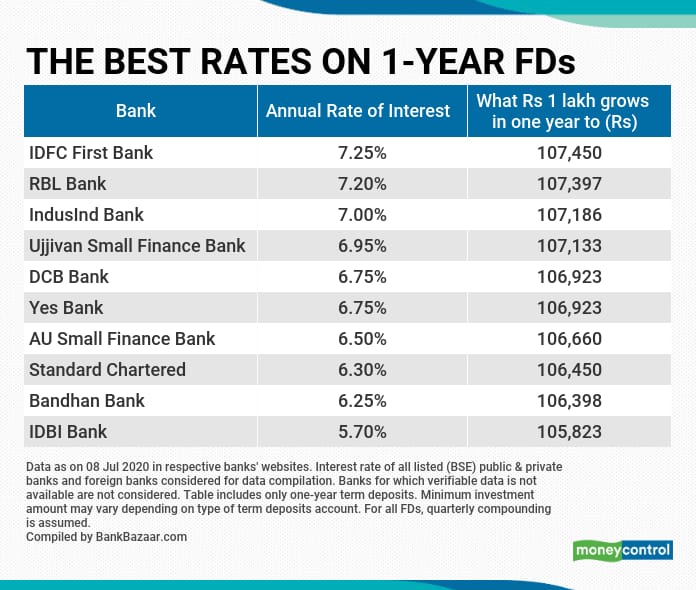

Interest rates ranging from 7% to 7.5% on fixed deposits (FDs) are offered by many banks. Kotak Mahindra Bank reduces home loan interest rate to 6.65% till March 31. Fixed deposit rates.

- Fixed deposit - Avail attractive fixed deposit interest rates on regular fixed deposits at Kotak Mahindra Bank to earn high returns on your investments. Click here to learn more about fixed deposit features and benefits.

- Fixed Deposit Interest Rates In these times of uncertain returns, fixed deposits have become the most preferred banking instruments for planning a financially worry-free future for the family. Which is why Mahindra Finance’s Fixed Deposit scheme has been specially designed to assure you of guaranteed returns at highly competitive interest.

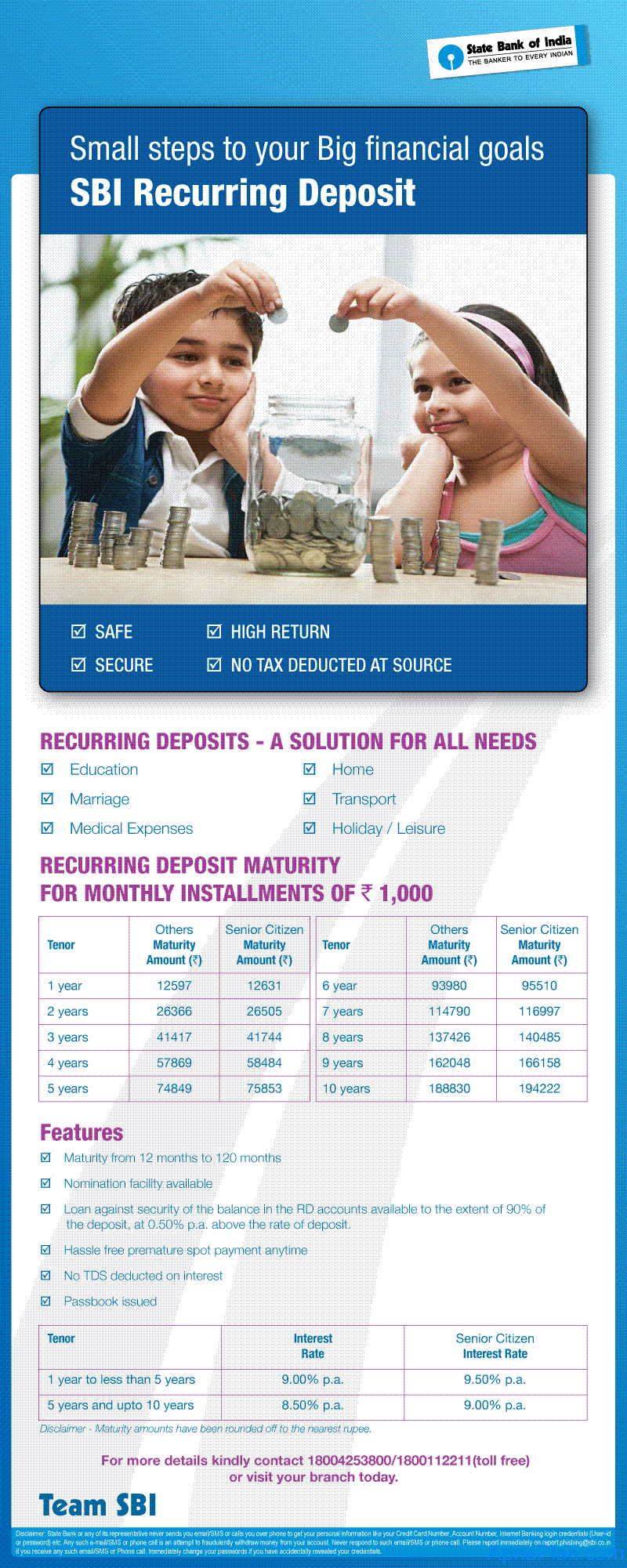

- SBI Fixed Deposit Schemes. The bank offers several fixed deposit plans to cater the diverse financial needs of the customers. It provides deposits for tenures ranging from 7 days to 10 years at varied interest rates. You can open a fixed deposit account with the lowest amount of INR 1,000.

- Jan 12, 2021 Deposit amount: Banks provide a comparatively lower rate of interest on bulk deposits exceeding Rs. Crore and higher rates on deposits less than 1 crore. DHFL Bank is one of the highest interest offering banks and provides an interest rate of up to 9.25% for fixed deposits.

Table of Contents

- 3 Fixed Deposit Schemes Offered by Kotak Mahindra Bank

- 4 Eligibility Criteria and Documents Required

- 4.4 Kotak Mahindra Bank Customer Care Number

About Kotak Mahindra Bank Fixed Deposit

Kotak Mahindra Bank, a leading Indian Private Sector bank, deals in fixed deposits to cater the diverse needs of the depositors. These deposit plans are for both existing and new customers. The bank offers the interest rate of up to 6.75% to the general public and 7.25% to the senior citizens. The investment can be made for the time period that suits the investor as the bank has set a wide range of tenure starting from 7 days to 10 years. Interest payment frequency is decided by the customer, i.e., you can receive your interest monthly, quarterly or at maturity. The deposits are easily liquidated. Interest is paid at special rates if the amount is not withdrawn. A customer can avail tax benefits and loan facility. Various deposit schemes are issued by the bank keeping in mind the different requirements of the customers. The investment plans you can opt for are as follows:

- Kotak Mahindra Bank Regular Fixed Deposits

- Kotak Mahindra Bank Senior Citizen Deposits

- Kotak Mahindra Bank Tax Saving Deposits

- Kotak Mahindra Bank Ace Deposits

Kotak Mahindra Bank FD Interest Rates March 2021

| Maturity Period | Less than INR 2 crore (For Regular Depositors) |

|---|---|

| 7 Days- 14 Days | 3.50% |

| 15 Days - 30 Days | 4.00% |

| 31 Days - 45 Days | 4.50% |

| 46 Days - 90 Days | 5.10% |

| 91 Days - 120 Days | 5.25% |

| 121 Days - 179 Days | 5.30% |

| 180 Days | 5.75% |

| 181 Days - 364 Days | 5.80% - 6.05% |

| 365 Days - 389 Days | 6.20% |

| 390 Days | 6.20% |

| 391 Days - less than 23 months | 6.20% |

| 23 months - less than 3 years | 6.10% |

| 3 years - less than 4 years | 6.10% |

| 4 years - less than 5 years | 6.00% |

| 5 years and above upto & inclusive of 10 years | 6.00% |

Fixed Deposit Schemes Offered by Kotak Mahindra Bank

Kotak Mahindra Bank Regular Fixed Deposits

Regular fixed deposit is the scheme that has several interest payout options. That is, the depositor can receive interest as per his requirements. The depositor can decide when he/she wants the interest on the principal amount. The minimum tenure of 181 days is necessary for monthly interest payout.

The minimum amount required to invest in Regular Fixed Deposit is INR 10,000 for the existing customers. However, the minimum investment amount for new customers is INR 25,000.

Kotak Mahindra Bank Senior Citizen Deposits

The bank offers a special rate of interest on deposits to senior citizen. Any residential Indian citizen above 60 years of age can avail advantage of this scheme. The new customers need to submit a valid age proof along with the application form. Alike regular fixed deposit, senior citizens too, have the facility of choosing from multiple interest payout options.

| Particulars | Details |

|---|---|

| Minimum Investment Amount | INR 10,000 INR 25,000 (for new customers) |

| Minimum Tenure | 7 days |

| Maximum Tenure | 10 years |

| Interest Payout Frequency | Monthly, quarterly or at maturity |

| Nomination Facility | Available |

| Sweep-in-Facility | Available |

| Partial/Premature Withdrawal | Allowed |

| Loan/Overdraft | Available |

Kotak Mahindra Bank Tax Saving Deposits

You can save tax under Section 80C of Income Tax Act and earn returns on your deposit by investing in Kotak Mahindra Bank Tax Saving Scheme. An initial deposit of INR 5,000 is required to open a term deposit.

| Particulars | Details |

|---|---|

| Initial Deposit Amount | INR 5,000 |

| Minimum Tenure | 5 years |

| Maximum Tenure | 10 years |

| Lock-in-Period | 5 years |

| Nomination Facility | Available |

| Partial/Premature Withdrawal | Not allowed |

| Interest Payout Frequency | Quarterly, at maturity |

Documentation of Tax Saving Deposits

The following can apply for Tax Saving Deposit with the requisite documentation:

| Resident Individuals, Hindu Undivided Family | 1. Proof of identity: PAN card, Voter ID Card, Passport, Driving license 2. A photograph 3. KYC Form |

Kotak Mahindra Bank Ace Deposits

It is a mixture of fixed deposit and mutual fund investment. The interest earned on deposit is invested in an equity mutual fund, by way of Systematic Investment Plan through Standing Instructions placed on savings accounts. This plan ensures the safety of principal amount and the investor is subjected to earn higher returns.

An initial deposit of INR 10,000 is required for this term deposit.

Eligibility Criteria and Documents Required

| Depositor Type | Documents |

|---|---|

| Resident Individuals, Hindu Undivided Family, Sole Proprietorship Concern | 1. Proof of identity: PAN card, Voter ID Card, Passport, Driving license 2. A photograph 3. KYC Form |

| Trusts | 1. Copy of the Trust Deed 2. Copy of the registration certificate 3. Copy of the Resolution of The Trustees 4. Authorising the members concerned to open and operate the account 5. Photographs of the members operating the account |

| Associations / Clubs | 1. By-laws of the Association 2. Copy of the Resolution by the board authorising the members concerned to open and operate the account 3. Photographs of the members operating the account |

| Partnership Firm | 1. Partnership Deed 2. Letter from partners approving the persons concerned to open and operate the account 3. Photographs of the persons operating the account |

| Public or Private Public Public or Private Limited Companies: | 1. Board Resolution / Authority Letter 2. Memorandum & Articles of Association 3. Certificate of Incorporation 4. Certificate of Commencement of Business (Public Limited Company) 5. Form 32 in case list of directors are not original subscribers to Memorandum & Articles of Association (in case of Private Limited Cos) Duly acknowledged by ROC 6. Governing Act / Rules and Regulations(PSUs) (certified true copy) |

Features/Benefits

- Wide range of tenure

- Easy liquidity

- Good interest rate

- Overdraft facility available

- Facility of net banking

Kotak Mahindra Fixed Deposit Calculator

The calculator helps you know in advance the end result of your investment. You can accordingly plan, the amount of deposit and the time period for which you want to invest.

The maturity amount payable depends upon the amount invested, the tenure of investment and the rate of interest on that tenure.

How to Apply

Both existing and new customers can apply for the fixed deposits at Kotak Mahindra Bank. You can apply in the mentioned schemes as per your eligibility. The schemes are open for investment online as well as at the branch offices.

Kotak Mahindra Bank Customer Care Number

All your queries and doubts get answered by customer care executives. You can call anytime on the helpline number as the service is available 24 X 7. Give a call on 1860 266 2666.

Want to earn safe returns on your investments? Then, look to invest in a fixed deposit that offers fixed returns over time. But the big question is, where should you open a fixed deposit? The question assumes significance given there are many banks and non-banking finance companies (NBFCs) waiting to make you a customer. But the largest public sector bank State Bank of India (SBI) has a distinctive advantage over others. The reason being the attractive interest rates as well as the massive PAN India presence with around 25,000 branches across the country. It won’t be wrong to say that SBI fixed deposit is a symbol of trust. Catch more of it in this page.

Table of Contents

- 2 SBI Fixed Deposit Interest Rates and Other Details

- 4 How To Apply for State Bank of India Fixed Deposit?

- 5 SBI Fixed Deposit Form

- 5.1 A Look at SBI’s Branch Network

SBI Fixed Deposit Schemes

The bank offers several fixed deposit plans to cater the diverse financial needs of the customers. It provides deposits for tenures ranging from 7 days to 10 years at varied interest rates. You can open a fixed deposit account with the lowest amount of INR 1,000. Interestingly, the 5-year tax saver fixed deposit of SBI doesn’t come with the maximum limit on deposits. You have the option to select the investment period and the amount of investment as per your financial goals. Depositors can receive interest at the payout frequency decided by them.

SBI Fixed Deposit Interest Rates and Other Details

| Fixed Deposit Aspects | Details |

|---|---|

| Minimum Deposit Amount | INR 1,000 |

| Maximum Deposit Amount | No Limit |

| Rate of Interest | 2.90% - 6.20% per annum |

| Tenure | 7 days to 10 years |

| Loan Facility | Upto 90% of the Principal Deposit |

| Premature Withdrawal Facility | Available |

| Interest Payout Frequency | Monthly/ Quarterly/ Half Yearly/ Yearly |

SBI Fixed Deposit Interest Rates March 2021

SBI Fixed Deposit Interest Rates generally range from 2.90% - 6.20% per annum which is quite high seeing the current market standards. The bank pays an additional interest to senior citizens. To know the FD interest rate of different investment periods, check the interest rate table given below:

Interest Rates on Retail Deposits Below INR 2 Crore

Fixed Deposit Rates Singapore

| Deposit Periods | Interest Rates for General Public (in per annum) | Interest Rates for Senior Citizens (in per annum) |

|---|---|---|

| 7 - 45 Days | 2.90% | 3.40% |

| 46 - 179 Days | 3.90% | 4.40% |

| 180 - 210 Days | 4.40% | 4.90% |

| 211 Days - Less Than 1 Year | 4.40% | 4.90% |

| 1 Year - Less Than 2 Years | 5.10% | 5.60% |

| 2 Years - Less Than 3 Years | 5.10% | 5.60% |

| 3 Years - Less Than 5 Years | 5.30% | 5.80% |

| 5 Years - 10 Years | 5.40% | 6.20% |

Kotak Fixed Deposit Rates 2020

Interest Rates on Retail Deposits of INR 2 Crore and Above

| Deposit Periods | Interest Rates for General Public (in per annum) | Interest Rates for Senior Citizens (in per annum) |

|---|---|---|

| 7 - 45 Days | 2.90% | 3.40% |

| 46 - 179 Days | 2.90% | 3.40% |

| 180 - 210 Days | 2.90% | 3.40% |

| 211 Days - Less Than 1 Year | 2.90% | 3.40% |

| 1 Year - Less Than 2 Years | 2.90% | 3.40% |

| 2 Years - Less Than 3 Years | 3.00% | 3.50% |

| 3 Years - Less Than 5 Years | 3.00% | 3.50% |

| 5 Years - 10 Years | 3.00% | 3.50% |

SBI Fixed Deposit Calculator

The SBI Fixed deposit calculator is the tool which gives an exact idea about the amount of interest that you can get on the principal amount deposited under the scheme. Using it they can calculate the total amount they are likely to receive after the maturity of the fixed deposit. They can even reinvest the interest amount to yield more interest at maturity.

How To Apply for State Bank of India Fixed Deposit?

To apply for a fixed deposit at SBI, the candidate needs to fill the application form by visiting the nearest bank branch. Other way is to download the application form from the bank’s official website and submit it along with the requisite documents at the branch office. Candidates can even open the FD account online from the comfort of your home/office and save your precious time. You must have the following to apply online.

- Savings Account with SBI

- Internet banking username and password

- At least one transaction account should be mapped to the username

Steps To Apply Online

- Log in to the Online SBI account.

- Enter the username and password

- Click on the Login button

- Once the savings account is visible, click on the e- Fixed Deposit link provided on the menu.

- On clicking, the page will open where the depositor can create various deposits online.

- From the left-hand side menu, select the e-TDR/STDR option.

- Now feed the savings account number that is to be debited. Enter the amount and select the TDR or STDR option.

- Click on the confirmation button. Now, the online fixed deposit account is generated.

SBI Fixed Deposit Form

The SBI fixed deposit form is available online as well as at branch offices. In order to avail the benefits of fixed deposits, you need to fill the following details in the form:

- Customer status – existing customers or new to the bank

- Applicant’s details

- Co-applicant’s details

- Funding account details i.e., the account to be debited

- Term of deposit

- Product name or the name of deposit scheme

- Frequency of interest payable

- Details of account in which interest is to be credited

- Maturity instructions (tenure of policy, auto-renewal)

- Signature of both the customers

A Look at SBI’s Branch Network

SBI is an Indian multinational, public sector banking and the financial company which has its headquarters in Mumbai. It is one of the most trustworthy bank in the country. It has a wide network of 14,000 branches spread across the country.